Selling coins for cash can be a profitable venture, but knowing the right steps ensures you get the best value. Whether you’ve inherited a coin collection, are liquidating assets, or just want to turn old coins into cash, this guide will help you navigate the process effectively.

Step 1: Assess Your Coin Collection

Before selling, it’s essential to evaluate your coins properly. This will help determine their worth and potential market demand.

What to Look For

- Metal Composition – Gold, silver, and platinum coins typically have higher value than base-metal coins.

- Rarity – Limited mintage, historical significance, and special mint errors increase a coin’s value.

- Condition (Grading) – Coins are graded on a scale from Poor (P-1) to Mint State (MS-70). Higher grades fetch better prices.

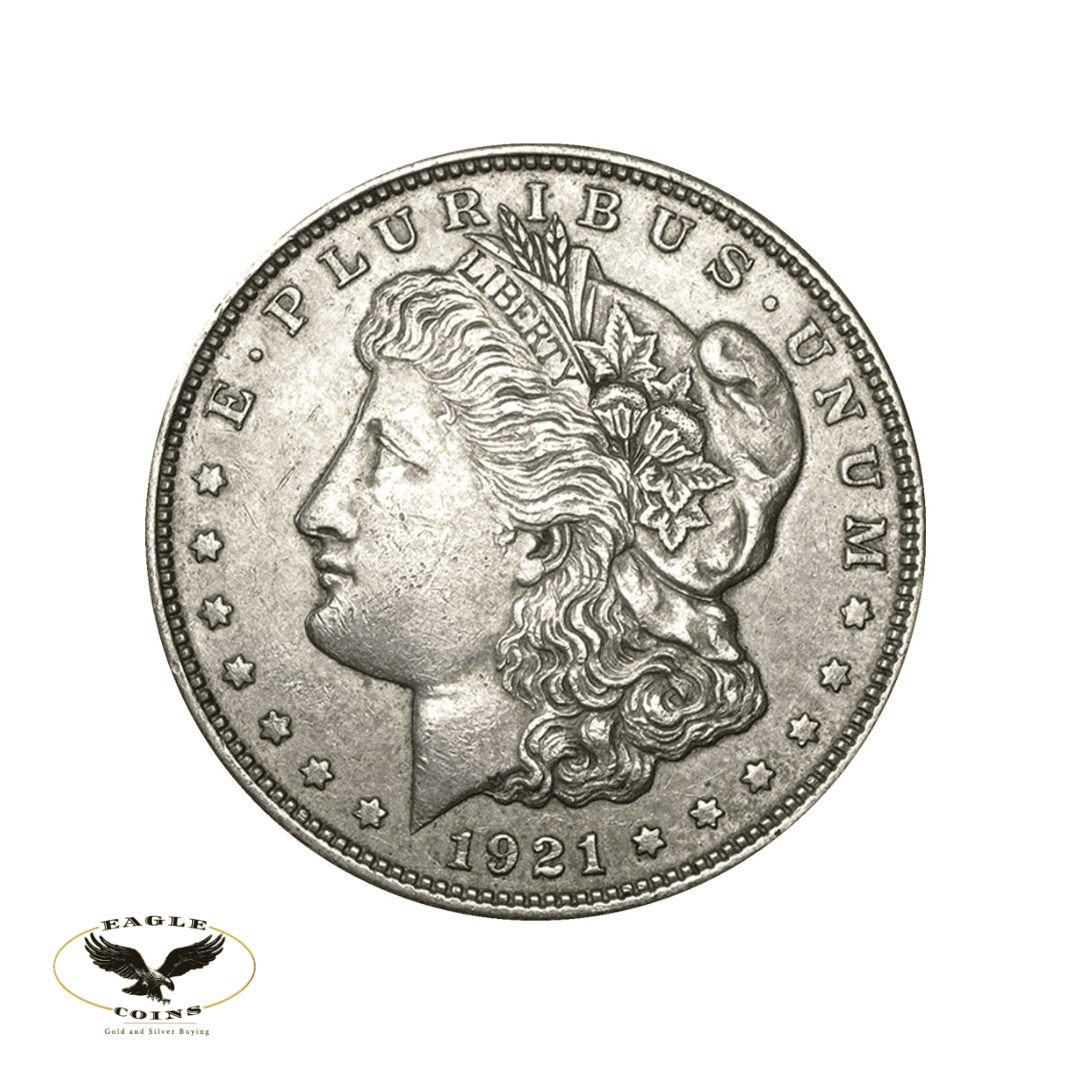

- Demand & Popularity – U.S. Morgan Dollars, American Eagles, and pre-1933 gold coins are always in demand.

Tip: Avoid cleaning your coins, as this can reduce their value significantly. Collectors prefer original patina and condition.

Step 2: Research the Value of Your Coins

Not all coins are worth their face value—some can be worth thousands.

Where to Check Values

- Online Price Guides – Websites like PCGS, NGC, and Coinflation provide real-time price updates.

- Auction Records – Check previous auction sales on platforms like Heritage Auctions and eBay.

- Coin Dealer Quotes – Professional dealers can give a ballpark estimate based on market trends.

- Precious Metals Spot Price – If selling bullion coins, track gold and silver prices.

Example Coin Values (2024 Market Estimates)

| Coin Type | Estimated Value Range (Depending on Condition) |

| Morgan Silver Dollar (1921) | $30 – $300 |

| American Gold Eagle (1 oz) | $2,000 – $2,200 |

| Indian Head Penny (1909-S) | $300 – $2,500 |

| Saint-Gaudens $20 Gold Coin | $2,200 – $5,000+ |

Did You Know? A rare 1933 Double Eagle Gold Coin sold for $18.9 million at auction in 2021.

Step 3: How Rarity and Uniqueness Impact Value

Collectors and investors are always on the lookout for rare and unique coins. Several factors contribute to a coin’s rarity, which can significantly affect its market price.

What Makes a Coin Rare?

- Low Mintage Numbers – Coins with fewer units produced are generally more valuable.

- Historical Significance – Coins tied to major events, such as Civil War-era currency, attract higher demand.

- Mint Errors – Misprints, off-center strikes, and missing details can make a coin extremely valuable.

- Discontinued Series – Coins that are no longer in circulation, like pre-1933 gold coins, often appreciate in value.

Examples of Rare Coins and Their Values

| Rare Coin | Notable Feature | Auction Price |

| 1913 Liberty Head Nickel | Only 5 exist | $4.5 million |

| 1794 Flowing Hair Silver Dollar | First U.S. silver dollar | $10 million |

| 2000 Sacagawea Dollar (Experimental Rinse) | Unique golden tint | $7,500+ |

Pro Tip: If you think you own a rare coin, have it professionally appraised before selling. You may be sitting on a hidden fortune.

Step 4: Choose the Right Selling Method

Different selling options cater to different types of coin collectors and investors.

Best Places to Sell Coins for Cash

| Selling Option | Pros | Cons |

| Local Coin Dealers | Quick transactions, expert evaluation | May offer lower prices than auctions |

| Online Marketplaces (eBay, Craigslist) | Wider audience, competitive bidding | Scams, seller fees, shipping risks |

| Auction Houses | Potential for high prices, professional buyers | Takes time, auction fees apply |

| Bullion Dealers (for gold/silver coins) | Offers based on metal market price | No premium for rare numismatic coins |

| Pawn Shops | Instant cash | Often lower offers |

Pro Tip: Selling to reputable dealers like Eagle Coin ensures fair pricing, no hidden fees, and expert evaluation.

Step 5: Get Your Coins Appraised

A professional appraisal ensures you receive the correct valuation for your coins.

- Get Multiple Offers – Compare offers from multiple buyers to avoid underpricing.

- Choose Certified Dealers – Work with dealers accredited by organizations like the Professional Numismatists Guild (PNG) or American Numismatic Association (ANA).

- Ask About Payment Methods – Some buyers offer cash, checks, or wire transfers.

Where to Appraise? Local coin shops, online appraisal services, and major coin shows.

Step 6: Finalize the Sale

Once you’ve chosen the best selling method, close the deal securely.

- Negotiate When Possible – Dealers may be willing to offer slightly more if they see competition.

- Get a Receipt – Always request a detailed invoice for your records.

- Ship Securely (for Online Sales) – Use insured shipping with tracking when mailing coins to buyers.

Why Sell to Eagle Coins Gold and Silver Buying?

If you’re looking for a trusted coin buyer, Eagle Coins Gold and Silver Buying offers:

- Competitive Prices – Transparent pricing based on real-time market value.

- Expert Evaluation – Numismatic professionals assess your coins fairly.

- Secure Transactions – Safe and hassle-free selling process.

- Immediate Payment – Cash or bank transfers with no long waiting period.

Selling coins can be a simple and rewarding process when done right. Whether you’re cashing in on bullion, rare collectibles, or an inherited collection, following these steps will ensure you maximize your earnings.

Thinking about selling your coins? Contact Eagle Coins Gold and Silver Buying today for a free evaluation.